sales tax rate in tulsa ok

Adair County OK Sales Tax Rate. 7288 TULSA CTY 0367 7388 AGONER CTY W 130 7488 ASHINGTON CTY W 1.

Cutting The Top Income Tax Rate Who Benefits Oklahoma Policy Institute

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of. The Tulsa County sales tax rate is. As far as other cities towns and locations go the place with the highest sales tax rate is Glenpool and the place with the lowest sales tax rate is Leonard.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. Ada OK Sales Tax Rate. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. The Tulsa County Sales Tax is 0367. Achille OK Sales Tax Rate.

You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables. This is the total of state county and city sales tax rates. There is no applicable special.

The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax. 608 rows Average Sales Tax With Local. 0188 ADAIR CTY 175 0288 ALFA CTY ALF 2.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

To review the rules in. Denotes Use Tax is due for sales in this city or county from out-of-state at the same rate as shown. State of Oklahoma.

Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 5766. The current total local sales tax rate in Tulsa County OK is 4867. City Total Sales Tax Rate.

Effective May 1 1990 the State of Oklahoma Tax Rate is 45. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037. Select the Oklahoma city from the list of popular cities below to.

They do not have a sales or use tax. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 51.

March 1 2022 COPO LOCATION RATE CHANGE TAX TYPE TYPE OF CHANGE EFFECTIVE DATE 0703 ACHILLE 3 6201 ADA 4 4903 ADAIR 4. The Oklahoma sales tax rate is currently. Fast Easy Tax Solutions.

The most populous zip code in Tulsa County Oklahoma is. Sales Tax in Tulsa Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. State of Oklahoma - 45.

The Tulsa sales tax rate is. You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402.

The County sales tax rate is. There are a total of 470 local tax jurisdictions across the state collecting an average local tax of 4242. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

The 2018 United States Supreme Court decision in South Dakota v. Ad Find Out Sales Tax Rates For Free. What is the tax rate in Tulsa County.

Some cities and local governments in Tulsa County collect additional local sales taxes which can. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. The most populous location in Tulsa County Oklahoma is Tulsa.

The Tulsa County Sales Tax is collected by the. Oklahoma has recent rate changes Thu Jul 01 2021. The Oklahoma state sales tax rate is currently.

Rates Effective January through March 2022 Updated. The December 2020 total local sales tax rate was also 4867. Adair OK Sales Tax Rate.

Has impacted many state nexus laws and sales tax collection requirements. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

The average cumulative sales tax rate between all of them is 828. This is also in addition to the State Tax Rate of 45. With local taxes the total sales tax rate is between 4500 and 11500.

31 rows The state sales tax rate in Oklahoma is 4500.

6 Steps To State Sales Use Tax Compliance In The Wake Of Wayfair

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Transit Advertising For Financial Institutions Financial Institutions Banks Advertising Advertising

Mri Technologist Salary In Tulsa Ok Comparably

How To Charge Sales Tax On Avon Orders Youtube

Sales Tax Exemption Letter For Oklahoma State Gov T Entities

Woodspring Suites 10 Reviews Hotels 11000 East 45th St Tulsa Ok Phone Number Yelp

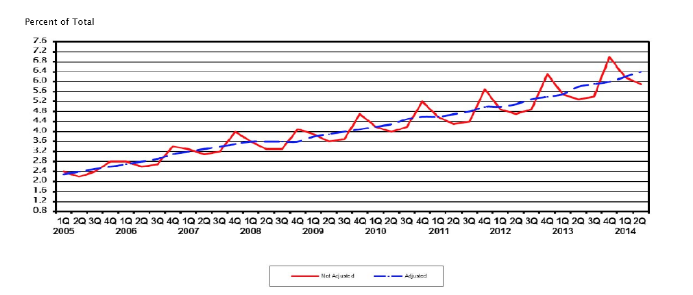

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Taxes Broken Arrow Ok Economic Development

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Okmulgee Grocery Store Seeks Federal Ruling On State Tribal Sales Tax Dispute

Retailers Survey Shows South Dakotans Think Current Sales Tax Rate Is About Right Few Would Support Adding A Personal Income Tax

Edmond Residents Approve Temporary Sales Tax To Purchase Land Near Hafer Park Kfor Com Oklahoma City

Taxing Goods And Services In A Digital Era National Tax Journal Vol 74 No 1

Taxing Goods And Services In A Digital Era National Tax Journal Vol 74 No 1

Use Tax For County Government Oklahoma State University

Cutting The Top Income Tax Rate Who Benefits Oklahoma Policy Institute

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute